To create Appendix 8A:

Click IRAS Submissions >> A8A >> Create.

Main Menu

The Appendix 8A(A8A) Create page will be displayed.

Appendix 8A(A8A) Create Page

Select the Year (Y.E. 31 Dec), Employer Tax Ref No and Source from the respective drop-down lists.

Click

![]() to add new records. The Create Employee page will be displayed.

to add new records. The Create Employee page will be displayed.

Create Employee Page

Select the ID Type from the drop-down list and enter the ID No for the selected ID Type.

Enter the Full Name of Employee as per NRIC/FIN. Refer to the below table for ID Type selection.

Type |

Description |

Format of the ID |

NRIC |

Applicable for a Singapore Citizen or Permanent Resident |

with prefix ‘S/T’ |

FIN |

Applicable for a foreigner who is holding a work permit or employment pass |

with prefix ‘F/G’ |

Immigration File Ref No (IMS) |

Applicable to foreign workers. This number is issued by ICA to foreign workers | NNNNNNNNC N is numeric and C is a check digit |

Work Permit (WP) |

Work Permit No. |

N_NNNNNNNC (where _ is a space) N is numeric and C is a check digit. |

Malaysia I/C (M I/C) |

Malaysian I/C. Applicable only for the following designations:

|

Consists of 7 to 8 alphanumeric characters or 12 numeric characters. |

Passport No (PP) |

Passport Number. Applicable only for the following designations:

|

|

Click

![]() . The Value

of Place of Residence, Utility & Hotel tab will be displayed.

. The Value

of Place of Residence, Utility & Hotel tab will be displayed.

Create Employee Page - Value of Place of Residence, Utility & Hotel tab

Enter the required details.

Click  . Others tab will be displayed.

. Others tab will be displayed.

Appendix 8A (A8A) Create Employee Page - Others tab

Enter the required information.

Click

![]() to save in draft status. You will

be directed to the Appendix 8A(A8A)

Create

page along with the created/saved record.

to save in draft status. You will

be directed to the Appendix 8A(A8A)

Create

page along with the created/saved record.

Appendix 8A (A8A) Create Page - Saved Details

|

· You can update at any point of time before submitting. To update the record, click the Employee ID hyperlink. · Once submitted it can only be amended. · To add another employee, click

|

To

save the A8A batch, click ![]() . A

confirmation message will be displayed.

. A

confirmation message will be displayed.

Confirmation Message

|

The number of employee records in the batch should match with the number entered for this verification. |

To

send the A8A to IRAS, verify the records by entering the number of

employee records within the batch, and then click ![]() .

.

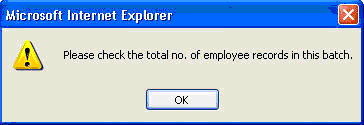

If the number of employee records is entered incorrectly, an error message will be displayed.

Error Message

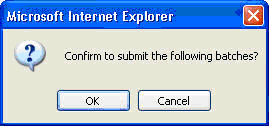

If number of employee records is entered correctly, a confirmation pop-up message will be displayed.

Confirmation Submission Message

|

Ensure that the batch does not contain any employees with no amount declaration ($0 amounts) and the Send Status is Success. |

A8A Sent - Confirmation Message